Once the cuts are fully realized, starting with the fiscal year that begins July 1, 2022, Oklahoma is forecast to collect about 347 million less in tax revenue each year. Out of an abundance of caution, you should. with possible exceptions for certain farmersthe Oklahoma tax return does require the Oklahoma NOL be tracked separately from the Federal NOL. Oklahoma will lose about 137 million in state tax revenue in the current fiscal year due to the cuts. The standard deduction for heads of households will increase to 20,800 for the 2023 tax yearup 1,400 from the 2022 tax year. Single is the filing type you select if you are not married, do not have children, and have no dependants for example.įiling as Single generally results in paying higher federal and Oklahoma state income tax rates compared to the other four filing statuses. Tax cuts come at a price to state government.

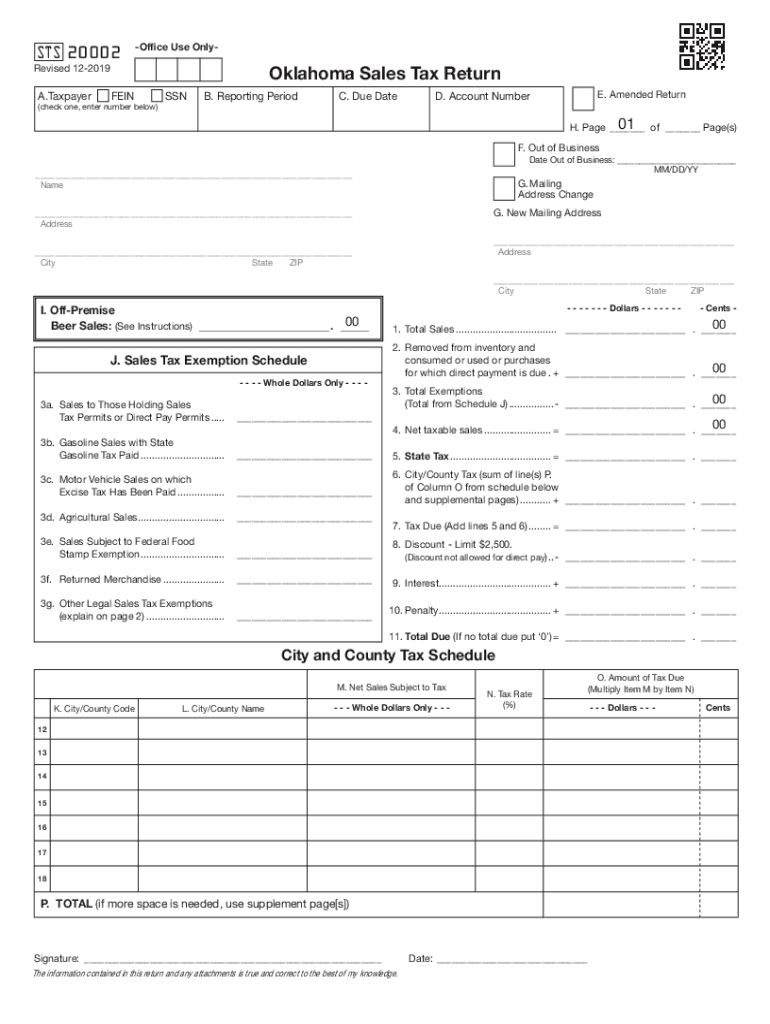

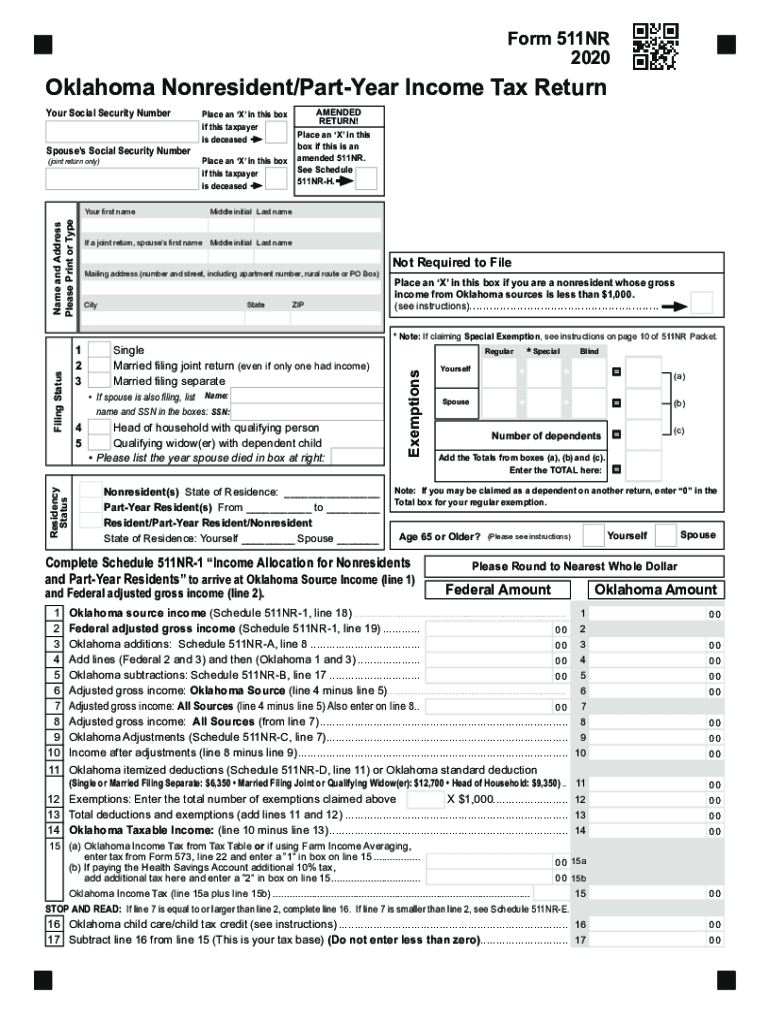

These five filing status are visible as check boxes on both the IRS Form 1040 and the Oklahoma Form 511. There are five filing status available to Oklahoma state taxpayers: Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow. Oklahoma’s tax system ranks 23rd overall on our 2023 State Business Tax Climate Index. The tax rates used in the withholding methods decreased by 0.25 percentage points each and range from 0.25 to 4.75, instead of the 0. 28 by the state tax commission and implement income tax decreases included in a bill signed earlier in 2021.

What is the Oklahoma Single income tax filing status? Oklahoma has a 4.50 percent state sales tax rat, a max local sales tax rate of 7.00 percent, and an average combined state and local sales tax rate of 8.98 percent. Oklahoma’s 2022 withholding methods were released Oct. Read the Oklahoma income tax tables for Single filers published inside the Form 511 Instructions booklet for more information. As a nonresident, you may be able to claim a Missouri income percentage, reducing your Missouri tax liability by taxing you only on your Missouri source. Residents of Oklahoma are also subject to federal income tax rates, and must generally file a federal income tax return by April 18, 2023.

0 kommentar(er)

0 kommentar(er)